Homeownership is a dream for many, but credit misconceptions can often be a roadblock. At Croskey Real Estate, we believe everyone deserves the chance to own a home. Let’s clear up some common credit myths to help you achieve your homeownership goals.

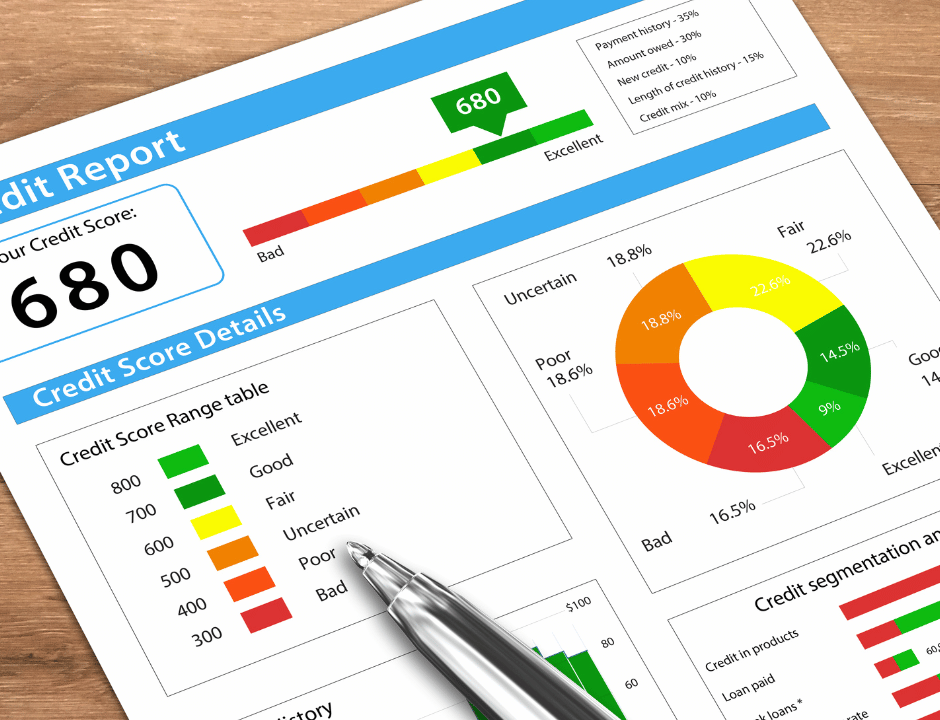

Understanding Your Credit Score

Homeownership is a dream for many, but credit misconceptions can often be a roadblock. At Croskey Real Estate, we believe everyone deserves the chance to own a home. Let’s clear up some common credit myths to help you achieve your homeownership goals.

Your credit score is a crucial factor in determining your mortgage interest rate. A higher score typically translates to better loan terms. Let’s clear up some misconceptions:

Myth 1: Checking Your Credit Score Hurts You.

Fact: Checking your credit score through a soft inquiry (such as when a dealership checks multiple lenders for the best auto loan rate) doesn’t impact your score. This applies when you’re inquiring with different banks for the same loan product. Regularly checking your credit score is a valuable tool to understand your financial health. Avoiding this could mean missing out on catching errors or understanding your true credit standing.

Myth 2: Closing Old Accounts Boosts Your Score.

Fact: Closing old accounts can potentially harm your credit score by reducing your credit history. Keeping older accounts open (even if you’re not using them) can be beneficial. Closing them can lead to a shorter credit history and a lower score, impacting your loan terms.

Myth 3: Paying Off Debt Removes It From Your Report.

Fact: While paying off debt is positive, the record of the debt (including late payments) remains on your report for up to seven years. Consistent on-time payments will help improve your score over time. Ignoring this could result in a false sense of security about your creditworthiness.

Myth 4: Your Score Can Change Randomly.

Fact: Every change in your credit score has a reason. New inquiries, large purchases, or account closures can all impact your score. Regularly reviewing your credit report can help you identify any issues. Neglecting this can leave you in the dark about potential problems.

Myth 5: Quick Fixes Can Dramatically Raise Your Score.

Fact: Building a strong credit history takes time and consistent responsible financial behavior. While there are steps you can take to improve your score, such as paying down debt and disputing errors, dramatic changes typically require time and effort. Falling for quick-fix schemes can lead to disappointment and financial setbacks.

Your credit score is a crucial factor in determining your mortgage interest rate. A higher score typically translates to better loan terms. Let’s clear up some misconceptions:

Myth 1: Checking Your Credit Score Hurts You.

Fact: Checking your credit score through a soft inquiry (such as when a dealership checks multiple lenders for the best auto loan rate) doesn’t impact your score. This applies when you’re inquiring with different banks for the same loan product. Regularly checking your credit score is a valuable tool to understand your financial health. Avoiding this could mean missing out on catching errors or understanding your true credit standing.

Myth 2: Closing Old Accounts Boosts Your Score.

Fact: Closing old accounts can potentially harm your credit score by reducing your credit history. Keeping older accounts open (even if you’re not using them) can be beneficial. Closing them can lead to a shorter credit history and a lower score, impacting your loan terms.

Myth 3: Paying Off Debt Removes It From Your Report.

Fact: While paying off debt is positive, the record of the debt (including late payments) remains on your report for up to seven years. Consistent on-time payments will help improve your score over time. Ignoring this could result in a false sense of security about your creditworthiness.

Myth 4: Your Score Can Change Randomly.

Fact: Every change in your credit score has a reason. New inquiries, large purchases, or account closures can all impact your score. Regularly reviewing your credit report can help you identify any issues. Neglecting this can leave you in the dark about potential problems.

Myth 5: Quick Fixes Can Dramatically Raise Your Score.

Fact: Building a strong credit history takes time and consistent responsible financial behavior. While there are steps you can take to improve your score, such as paying down debt and disputing errors, dramatic changes typically require time and effort. Falling for quick-fix schemes can lead to disappointment and financial setbacks.

Croskey Real Estate is Here to Help!

At Croskey Real Estate, we understand that navigating the homebuying process can be overwhelming. We have preferred lenders who are very knowledgeable about what mortgage program is the most beneficial for your home-buying goals and financial situation; they can offer a snapshot of whether you are mortgage-qualified, or if additional steps need to be completed. Our experienced agents can provide personalized insight and help you create a realistic home-buying plan.

Potential Consequences of Misunderstanding Credit

Misunderstanding your credit can lead to several consequences, including:

Higher Interest Rates: Poor credit can result in higher mortgage interest rates, making your home more expensive in the long run.

Loan Denials: Incorrect credit information can lead to loan application rejections, delaying your homeownership dream.

Financial Stress: Mismanaging credit can create financial stress and limit your future borrowing power.

Ready to turn your homeownership dreams into reality? Contact us today to get matched up with the perfect lender. Let us help you navigate the mortgage process and find the ideal home for you and your family.

Potential Consequences of Misunderstanding Credit

Misunderstanding your credit can lead to several consequences, including:

Higher Interest Rates: Poor credit can result in higher mortgage interest rates, making your home more expensive in the long run.

Loan Denials: Incorrect credit information can lead to loan application rejections, delaying your homeownership dream.

Financial Stress: Mismanaging credit can create financial stress and limit your future borrowing power.

Ready to turn your homeownership dreams into reality? Contact us today to get matched up with the perfect lender. Let us help you navigate the mortgage process and find the ideal home for you and your family.